Foundation of the Stock Market

Understanding investment in the stock market is crucial for those who want to grow their money. The stock market is a platform where you buy and sell company shares. These shares provide you with a portion of company ownership, which can be a source of dividends and capital gains. The stock market operates by first bringing companies’ shares to the market for public sale.

Importance of Investing in the Stock Market

The benefit of investing in the stock market is not just making money but also achieving your financial goals. When you invest in stocks, you put your funds into businesses that help them grow. This provides you with long-term financial growth and helps you build a strong financial base for the future.

History of the Stock Market

Understanding the history of the stock market is also important. It began in 17th-century Holland, where the first stock exchange was established. Later, the New York Stock Exchange and London Stock Exchange developed, forming the foundation of modern stock markets. This historical evolution helps you understand how the stock market developed and its current position.

Basic Terms of the Stock Market

It is essential to understand some basic terms of the stock market, such as ‘stock,’ ‘bond,’ ‘dividend,’ ‘portfolio,’ and ‘market capitalization.’ A stock is an equity share that provides ownership rights in a company. A bond is a fixed income security. A dividend is the portion of a company’s profits distributed to shareholders. A portfolio is a collection of your investments. Market capitalization represents a company’s total market value.

Approach to Investing in the Stock Market

Investing in the stock market requires a clear strategy. You need to decide whether you want to engage in short-term trading or long-term investing. In short-term trading, you try to benefit from stock price fluctuations, while long-term investing involves holding stocks for an extended period to allow their value to grow.

Investment Strategies

Understanding investment strategies helps you make effective investment decisions. You need to decide whether to invest in growth stocks, which offer high potential returns, or value stocks, which are undervalued. Diversification is also an important strategy where you spread your investments across multiple stocks and sectors.

Risk Management

Risks are inherent in stock market investments. It is crucial to understand risk management strategies to protect your investments. Stop-loss orders and limit orders help you control losses and lock in profits.

Fundamental Analysis

Fundamental analysis involves evaluating a company’s financial health and performance. This analysis is based on financial statements, earnings reports, and market trends. It helps you determine whether a stock is worth investing in or not.

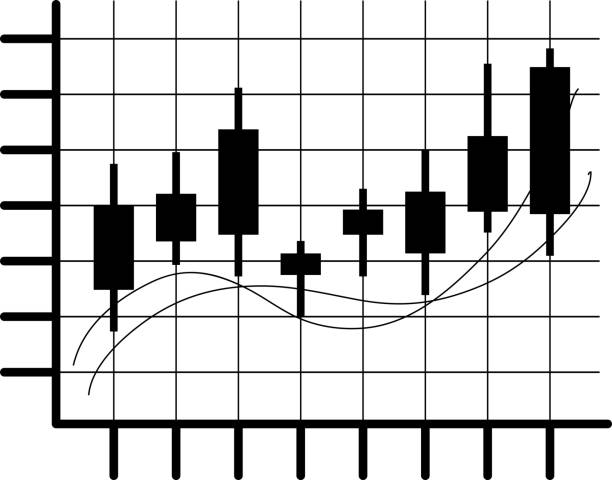

Technical Analysis

Technical analysis is performed by examining stock price movements and trading volumes. It uses charts and indicators to predict future price movements. This analysis helps you understand market trends and patterns that influence investment decisions.

Common Mistakes in Stock Market Investment

Avoiding common mistakes in stock market investment is crucial. These include emotional decision-making, lack of research, and market timing errors. You should remain disciplined and follow your investment strategy to avoid these mistakes.

Diversification and Asset Allocation

Diversification and asset allocation are essential for balancing your portfolio and managing risks. Diversification involves spreading your investments across different asset classes and sectors. Asset allocation manages the distribution of different assets in your portfolio to align with your risk tolerance and financial goals.

Tax Implications

Stock market investments come with tax implications. Understanding capital gains tax and dividend tax is important for maximizing your investment returns. By understanding the differences between long-term and short-term capital gains tax, you can manage your tax liability.

Online Trading Platforms

Nowadays, online trading platforms are very common. These platforms provide easy access and real-time data, which helps you make trading decisions. You should choose a reliable and user-friendly trading platform that meets your investment needs.

Stock Market Trends and Forecasting

Stock market trends and forecasting help you understand and predict future market movements. By analyzing economic indicators, political events, and global market trends, you can gauge future movements in the stock market.

Investment Goals and Planning

Investment goals and planning are crucial for your financial success. You should define your short-term and long-term financial goals and create a comprehensive investment plan to achieve them. Regularly reviewing and adjusting your investment strategy is also necessary to meet your goals in a timely manner.